Car Gst Rebate Period Malaysia

However the grace period will only apply to cars that are manufactured on June 2022 or earlier. This cannot be avoided and even though there will be some anger and disappointment coming from the middle class to the lower middle-class segment in Malaysia it must be noted that the real impact of the Goods and Services Tax GST.

Malaysia Sst Sales And Service Tax A Complete Guide

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

. Perusahaan Otomobil Kedua Sdn Bhd Perodua announced it will offer a cash rebate ranging between RM1000 and RM3800 for new vehicle purchases ahead of the zero-rated goods and services tax GST beginning June. Selling car prices in Malaysia will be moving upwards because of the GST and more. This is a continuation of the practice that has already been put in place in the earlier rounds of SST cut.

Malaysia GST Reduced to Zero. Local and foreign carmakers are throwing in an immediate cash rebate of between RM1000 and RM23000 for a brand new car as they trim the on-the-road OTR prices ahead of the zero-rated goods and services tax GST to be implemented in June. However three years later in May Malaysias Ministry of Finance announced that GST would be abolished and replaced by SST.

States to a recipient in Malaysia. Conditions For Refund Of GST Under Tourist Refund Scheme A tourist shall be entitled to the refund of GST under the TRS if she satisfies the following conditions. The two reduced SST rates are 6 and 5.

GST which is also known as value added tax in other countries is a tax. President Aishah Ahmad says she expects. For more information regarding the change and guide please refer to.

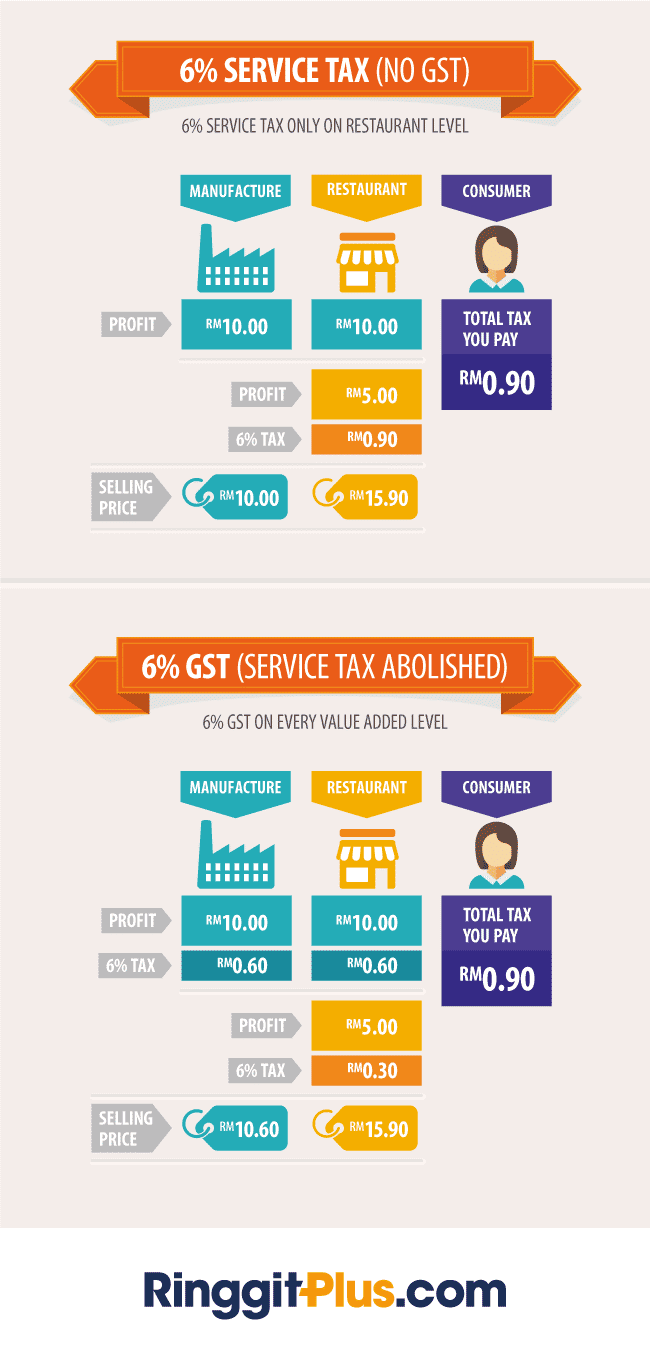

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The GSTHST rate to be used generally depends on several criteria such as the place of delivery and date of registration. Daniel Fernandez Jun 13 2022.

The 6 GST is being abolished and there will be a 2- or 3-month tax holiday before a 10 Sales and Services Tax is reintroduced. As such when it is taken out on April 1 it will be subject to a 6 GST instead of a 10 sales tax no complications there. Generally when you buy a specified motor vehicle from a GSTHST registrant for example a dealership the GSTHST applies on the sale.

A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the transition from GST to SST. Overview of Goods and Services Tax GST in Malaysia. GSTHST on the sale of a specified motor vehicle by a GSTHST registrant.

The MAA has confirmed today that there will be a one month grace period for car dealers to register the new cars. KUALA LUMPUR May 18. 24 Deemed input tax relating to cash payment made in a promotional.

It applies to most goods and services. Applying the de minimis rule in a tax year or longer period. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

GST GUIDE FOR INPUT TAX CREDIT 250413 3 Flat Rate Addition. It will be the same formula. She is neither a citizen nor a permanent resident of Malaysia not less than eighteen years of age and holds a valid international passport.

The carmakers are also offering discounts averaging 6 the same amount as the current GST rate. The Goods and Services Tax GST in Malaysia will be set to zero percent 0 effective 1 June 2018 Image via Bernama via NST All supplies of local and imported goods and services which are now subject to GST at the standard rate of 6 will be subject to GST at zero rate 0 beginning 1 June 2018. The ministry of finance has just announced that Malaysias goods and services tax GST currently set at six percent will be zero-rated come June 1.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. 24 Capital Goods Adjustment. The existing standard rate for GST effective from 1 April 2015 is 6.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. In addition Perodua said it will fully reimburse the GST to its customers who service their vehicle or buy.

Gst Rates In Malaysia Explained Wise

Malaysian Car Sales Expected Up With Gst Abolition Wardsauto

Gst Reimplementation Could Reduce Malaysian Car Prices Says Analyst But Is That Really The Case Paultan Org

Gst Reintroduction Could Raise Car Prices In Malaysia By 1 3 According To Aminvestment Bank Analyst Paultan Org

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

0 Response to "Car Gst Rebate Period Malaysia"

Post a Comment